U.K.-based insurtech company Marshmallow has raised $90 million in new funding as it looks to grow beyond car insurance and enter the broader financial services space. Known for leveraging data science to offer tailored car insurance to immigrants and underserved groups, the company now boasts over 1 million insured drivers and a profitable $500 million annual revenue run rate.

The fresh funding round, split evenly between equity and debt, values Marshmallow at just over $2 billion—a significant increase from its previous $1.25 billion valuation in 2021. Portage Capital led the round, with participation from BlackRock and Columbia Lake Partners, while earlier investors such as Passion Capital, Investec, and Scor also remain involved. To date, the company has raised around $220 million.

Marshmallow Financial Services Expansion

Marshmallow plans to use the new capital to launch lending products later this year, as part of its broader goal to become a “one-stop shop” for financial and insurance services. The startup is also preparing to introduce home insurance, designed to support individuals adjusting to life in the U.K.

Co-founder and CEO Oliver Kent-Braham emphasized that migration presents a key growth opportunity, pointing to the 1.2 million people who moved to the U.K. in 2024 alone. “The U.K. needs migration to boost its workforce,” he said. “We want to help people integrate and thrive here.”

Standing Out in a Shifting Insurtech Market

Marshmallow’s funding comes at a time when the European insurtech landscape is mixed. While companies like WeFox are struggling with declining valuations and restructuring, others like Ominimo—a bootstrapped Polish startup that recently raised $10 million at a $200 million valuation—are showing that profitable growth is still possible.

Marshmallow has seen exponential growth since 2021, when it had just 100,000 policyholders. Its branding has become highly visible in cities like London, supported by a bold pink advertising campaign.

Marshmallow has a focus on Inclusion and Innovation

What truly sets Marshmallow apart is its commitment to inclusivity and innovation. Co-founded by identical twins Oliver and Alexander Kent-Braham, alongside David Goaté, the company is one of only two Black-founded unicorns in the U.K., the other being WorldRemit.

Investors see strength in this diversity. “This is a very strong founding team,” said Devon Kirk, GP and co-head of Portage Capital Solutions. “We believe financial services benefit from different perspectives and inclusive leadership.”

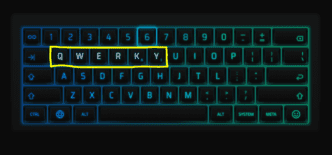

As it prepares to launch new financial products, Marshmallow continues to challenge traditional insurance models with AI-driven risk prediction, diverse leadership, and a customer base often overlooked by legacy players.