Volution VC, a leading UK-based venture capital firm, has announced the launch of a new $100 million fund designed to tackle one of the UK’s most persistent challenges: the lack of funding for startups moving from Series A to Series B. In 2024, Series A funding levels dropped by 44% year-on-year, and the conversion rate from Series A to Series B has plunged by over 50% over the last five years. Volution’s new fund aims to address this critical gap by supporting companies with established revenue streams that need capital to scale.

The fund is launched in partnership with SBI Investment Co., Ltd., one of Japan’s leading venture capital firms. Through a co-GP (general partner) structure, the partnership strategically shares risk and offers joint oversight, a model growing in popularity amid volatile global markets. This collaboration also grants UK tech startups greater access to Japan’s corporate networks and its $3.6 trillion pension fund market, offering fresh expansion opportunities.

At a time when the UK faces a productivity crisis — output per hour worked fell 1.8% year-on-year in Q3 2024 — Volution’s focus on automation, process optimization, and AI-driven solutions closely aligns with economist recommendations for reversing stagnation. By investing in FinTech, AI, and SaaS businesses that directly address productivity challenges, Volution is positioning itself as a catalyst for economic growth and innovation.

The fund also arrives against the backdrop of strengthening UK-Japan economic ties, particularly through initiatives like the Hiroshima Accord, which promotes cross-border technology collaboration. Japanese investors, known for their long-term strategic outlook, are increasingly seeking exposure to fast-growing international markets. This partnership reflects a mutual commitment to driving innovation and productivity across both economies.

Closing the Series A to Series B Gap

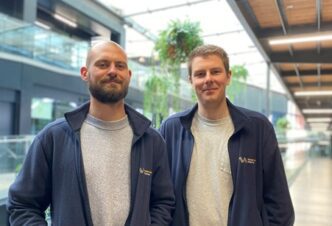

Volution VC, co-founded by James Codling and Edward Peter Bardos in 2021, was built around a clear mission: to support promising tech companies stuck between early-stage enthusiasm and later-stage growth hurdles. While early-stage investment has been heavily supported through tax-efficient schemes, much of the available capital dries up after Series A rounds. As Codling notes, “Companies get sold, fold, or become walking zombies” when they can’t secure the funding they need to reach the next level.

Volution targets companies that have already achieved significant traction, typically demonstrating at least £5 million in annual recurring revenue (ARR).

Importantly, the fund is also committed to fostering a strong entrepreneurial community. Volution shares best practices across its portfolio and integrates environmental, social, and governance (ESG) principles into its investment model. Initiatives like the “carbon carry” scheme ensure that the firm reinvests part of its profits into carbon offset projects, aligning with the global shift toward sustainability and regulations like the EU’s upcoming emissions reporting mandates.

The firm already boasts an impressive track record from its first fund, having achieved 300% average revenue growth across 11 companies, with three successful exits and one unicorn — Zopa Bank. Zopa, notably, reduced its operational emissions by 40% through cloud migration in preparation for a planned IPO in 2025.

The new fund has already started deploying capital, including investments in an AI-powered supply chain optimization platform and a blockchain-based ESG reporting tool. These sectors are forecasted to grow at a compound annual growth rate (CAGR) of 28% through 2030, aligning with Volution’s thesis of backing companies positioned for robust, long-term expansion.

Janine Hirt, CEO of Innovate Finance, welcomed the announcement, stating, “The launch of the Volution SBI Co-GP vehicle is a testament to the global strength of the UK’s FinTech sector. It addresses a critical funding gap and supports the growth of UK businesses seeking global expansion.”

Similarly, Michael Moore, Chief Executive of the BVCA, emphasized, “The SBI Volution Venture Fund taps into the strengths of Britain’s leadership in FinTech and AI. Its focus on scaling businesses is vital for capitalizing on emerging opportunities in a rapidly evolving market.”